How Business Owners In Nigeria Can Obtain Tax Clearance Certificate With The F.I.R.S

What exactly is a Tax Clearance Certificate and why do Companies need it? Perhaps, you are asking. Well, the idea behind this write-up is to show you a practical approach by which you can obtain a Tax Clearance Certificate for your company provided you are transacting business in Nigeria

First, a description of Tax Clearance Certificate

A Tax Clearance Certificate (TCC) as it is popularly called, is a written evidence from the Federal Inland Revenue Service (F.I.R.S) acknowledging that a company’s tax affairs at a particular point in time is up-to-date as at the time of issuance of the Certificate.

It is the responsibility of the F.I.R.S to issue Tax Clearance Certificate after ascertaining that the company’s tax liability (amount owed the Federal Government) has been fully paid and there's nothing outstanding. Where this is established, the TCC should be ready for pick up in four weeks max.

(Sidenote: This information is for educational purposes only)

If you're interested in owning one, please, talk to your Tax Consultant). But then it is not as easy as it sounds as there are a couple of intricacies involved before your company can be issued a TCC.

In order for your company to be issued a TCC, first, your company would have been issued a TIN (Tax Identification Number). That means your company would have registered with the F.I.R.S as a “Taxpayer” to be issued a TIN.

What is the meaning of Taxpayer Identification Number (TIN)?

Tax Identification Number is simply a UNIQUE NUMBER identification issued by the F.I.R.S to identify a person (company or individual) as a registered taxpayer in Nigeria. It is dedicated to ONE taxpayer alone. It is not transferable. A TIN is primarily issued in order to guide the tax payer in the remittance of his tax liabilities Consider this: Commercial banks have been mandated by the CBN to request for TIN from customers operating or opening a new corporate accounts before such accounts can become active.

It is also tied to many operations of government. As we progress, business owners all over the country will be issued a TIN because it is only through that the F.I.R.S will be able to maintain a comprehensive database of taxpayers.

One of the major reasons why TIN is hooked to your company account is because business transactions done in your business name will be captured at the portal of the FIRS and so monies due to the government in the form of withholding taxes and VAT will be adequately captured.In other words, there is no hiding place for the taxpayer who defaults in making remittances & other appropriate returns to the Government. TIN registration is a legal obligation of every person who operates a business in Nigeria.

How Does A Company Register As A Tax Payer?

The whole essence of registering as a tax payer is to show that your company is a responsible and statutorily complaint business entity carrying on business in the country. It is an obligation as required by law and also a forerunner to the issuance of a TIN (Tax Identification Number).So, in order to obtain a TIN, the tax payer will provide a number of information to the tax office (F.I.R.S) in his jurisdiction.

For a Limited Liability Company, such will register under the Corporate Registration while a Sole Proprietor will perfect his registration for T.I.N under the Individual registration at the F.I.R.S office close to his business.

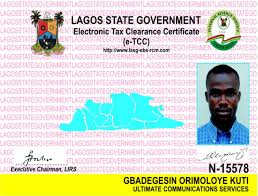

(Sidenote: The F.I.R.S does not issue TCC to Sole Proprietors. L.I.R.S (Lagos Internal Revenue Service) does in the case of Lagos State.)

Please, be clear with that.

To register as a Tax Payer, these are the following documents you'll provide:

1. Duly completed application form for TIN.

2. Certificate of Incorporation (for a Limited Liability Company) or Business Name Registration Certificate (for an enterprise) showing clearly the Registration Number (RC No.) in each case.

3. Documents containing the following information:

Address of company, enterprise or business

• Principal location of business

• Date of commencement of business

Once this is done and submitted to the Integrated Tax Office (ITO) in your jurisdiction, you are good to go.

Obtaining TIN (Tax Identification Number) is FREE.

It doesn’t come at any cost from the FIRS to you except for the consultancy fee paid to the tax consultant you engage to help you process it in the event that you are unable to do it yourself. the next question that comes to mind is:

Read also : Fowler’s tenure as FIRS Chairman.

what relevance is the Tax Clearance Certificate?

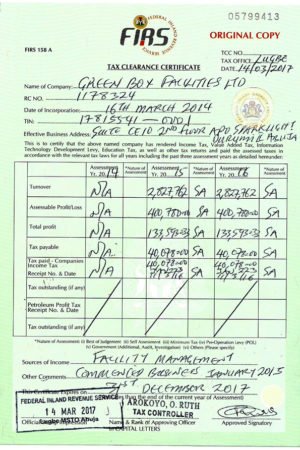

The relevance of a Tax Clearance Certificate cannot be underscored.Attached is an image of a TCC i googled, you’ll observe on the face it covers a period of 3 years in arrears.

What this means is that your tax returns are computed on Preceding Year Basis. What do I mean? Let’s assume, you applied for a Tax Clearance Certificate in March 2017. The face value of your TCC will reflect taxes paid three years backward excluding the year 2017 in which the application was made. It will show taxes paid in the year 2014, 2015 & 2016.You won’t be penalized and denied your Tax Clearance Certificate if you are yet to pay your tax for the current year 2017.This is what is meant by 'Preceding Year Tax.' There’s a formula for computing it.

Listed below are some of the crucial reasons why you need a Tax Clearance Certificate.

1. Application for certificate of occupancy

2. Application for award of contracts by Government, its agencies and registered companies

3. Application for Government loan for industry or business

4. Application for plot of land

5. Application for import or export license

6. Application for approval of building plans

7. Application for foreign exchange or exchange control permission to remit funds outside Nigeria

8. Registration of Motor Vehicle

9. Application for registration as a contractor

10. Confirmation of appointment by Government as chairman or member of a public board, institution, commission, company or to any other similar position made by the Government

11. Appointment or election into public office...

12. Stamping of guarantor’s form for a Nigerian passport

13. Application for transfer of real property

14. Application for trade license

15. Application for pools or gaming license

16. Application for firearms license

17. Application for agent license and any other transactions that may be determined from to time by the Government.

Conditions Under Which Tax Clearance Certificates May Be Issued By The FEDERAL INLAND REVENUE SERVICE.

This is practical. Not sharing theory In order to buttress my point, i’m going to share with us THREE case situations and the practical steps required to obtain company Tax Clearance Certificate under each scenario.

Undoubtedly, your situation should fall under one of these below if you are a company transacting business in Nigeria.Carefully consider these steps and take them to heart.

The case scenarios under which TCC can be obtained includes:

1) New Tax Payer Status – Assuming you incorporated your business with the CAC in January 2019 and you commenced business

Read also : How to know if tax deductions from your salary is remitted to tax authority in Nigeria.

immediately in the same year.

2) Assuming you incorporated your business in 1995 or later but did not commence business immediately until let’s say, 2013.

3) Assuming you incorporated & commenced business some years back but you are just filing in returns in 2015.

CASE STUDY #1(New Tax Payer Status)

Assuming You Incorporated Your Business In January 2019 & Then Commenced Operations Immediately – How Do You Obtain Tax Clearance Certificate Under This Situation ?

So many new tax payers fall under this category.These are business owners..who newly incorporated their businesses as a Limited Liability Company with the Corporate Affairs Commission But before I go further, i’ll want you to be clear on a few important stuff:

i) That is, before you can start off processing anything with the F.I.R.S, you would initially have sent in a written application on your company letter head addressed to the Tax Controller of the F.I.R.S Office in your business jurisdiction signed off by the Managing Director of your company.

ii) A letter appointing a firm of Chartered Accountants as your Auditor & Tax Consultant and:

iii) A letter of acceptance from the firm accepting to function in that capacity will all be submitted to FIRS.

iv) You’ll attach a copy of your Certificate of Incorporation and Memorandum & Articles of Association to the application...

Upon submission, these documents will sighted & acknowledged by a member of staff of F.I.R.S vested with the responsibility to do so, thereafter, you will be registered as a “TAXPAYER” with the F.I.R.S.Once this is perfected you will be told when to come for your TIN...

Know that you’ll also register for Value Added Tax by completing an application for VAT Registration and accompanying it with a Certificate of Incorporation, Memorandum & Articles of Association, Certified True Copy (CTC) of Form CAC 2 & CAC 7.Once the above are taken careof you’re good to go.

If your organization commenced business transaction in 2019 then by default, you are not expected to pay Income & Education Tax just yet, but you will start filing in returns for VAT and this will be on a monthly basis.You have a grace period of 18 months (1yr 6mths) after incorporation of your business to file in your annual returns.

What this means is that, assuming you started off in January 2019, then, you have up until June 2020 to file in your annual returns and then apply for TCC. But then, if you want to obtain your TCC within the year, you’ll have to show verifiable evidence to the tax authorities that you are just commencing business operations and that you need the TCC for something.

Now, your Tax Consultant will formally apply for your TCC.This will be done online as they do not encourage manual application anymore. An online account would've been created for your company and through that platform you will perfect your application. Once your application is received by FIRS, a mail will be sent informing you of the receipt of your application.

F.I.R.S will start off the processing of your Tax Clearance Certificate, though, it will take time, but your Tax consultant will be following up on it. Once it is ready, a mail will be sent to you informing you to download your TCC online...

Thereafter, subsequent transactions and correspondences with respect to your tax dealings will be handled by that particular tax office.

Sidenote: A Tax Consultant who knows the dynamics should help you once you commence your business just so you don’t make costly mistakes.

Read also : How to do your university clearance with little or no money.

CASE STUDY #2

Assuming you registered your business in 1995 or later but did not commence business operations immediately until let’s say 2013 - What do you do?...

We helped a client who had this unique challenge. A particular client of ours (name withheld) who deals in automobiles on the Island, though on a relative medium scale level was approached by a bank (name withheld) to supply a number of vehicles to the bank.

As a condition he needed to register with the bank as a contractor in order for him to be considered for the contract and one of the documents required of him to submit was a Tax Clearance Certificate. Now, the unique thing about this client of ours was that he incorporated his business on the 17th of March, 1995 when he left off paid employment to start his personal business, but as fate would have it, one thing led to another thing and so he abandoned his business & traveled out of the country.

Unfortunately, he never sought the advice of an Accountant to guide him on what he needed to do since he’ll be off running his business. Just the same way we have quite a couple of business owners register their businesses with the CAC & don’t do anything about it let alone seeking advice from accountants on what to do thereon.

So, in a bid not to lose the contract, he called on us to assist him process a Tax Clearance Certificate. This is someone who registered a business in 1995 and in 2014, he’s asking us to help him process a Tax Clearance Certificate to be presented to the bank for a contract.

So, what did we do? Did we tell him it was not possible? No!

This is what we did. The steps listed below are the applicable steps to follow in the event you have a similar challenge and don’t know what to do.

Step 1: The first thing we did was to identify the particular F.I.R.S office that was in charge of our client’s company just so we can familiarize and introduce ourselves as his representatives.

Sidenote: The “Tax Guys” first concern is COMPLIANCE

So, if you like speak the best of English, if your documents & your tax liability i.e. amount owed & expected to be paid is falling short, you will only be wasting your time discussing any other thing. In this wise, you need a skilled Tax Consultant who understand the dynamics to speak their language)

There are a couple of F.I.R.S offices scattered all over Victoria Island, Lagos.. Not knowing the particular F.I.R.S office in charge of our client's file, we had to move from one ITO to the other in order to establish it, and that we did after spending some hours on the road moving from one place to the other.

Step 2: A financial report called “Statement of Affairs” will be prepared.

A statement of affairs basically is a financial report that shows all the assets owned and liabilities owed by the business entity. An audit firm normally will prepare the statement of affairs for the relevant years i.e. the years of not filing the returns for the company to be submitted to F.I.R.S.

The audit firm will also affix a stamp & seal on the Statement of Affairs prepared. This is to authenticate the report to be submitted to the F.I.R.S.

Read also : Tips on saving and investing in the UK.

(Sidenote: A Pre-operation levy of N25,000 will be paid by companies that have incorporated their businesses with the CAC but are yet to commence business operations should they request for a Tax Clearance Certificate after six months of incorporation)...

(Also note, that the sum of N20,000 will be payable for subsequent years should the company decide it is not yet time to start off business operations. This payment will continue until it files in a notice of commencement of business)

Just so you know. The business was incorporated in 1995 with the Corporate Affairs Commission with an authorised share capital of 100,000 naira. What this means is that our client’s business had a face value N100,000. The Statement of Affairs was prepared taking that into consideration for the years of inactivity and submitted thus to the F.I.R.S.

Mark this down: It is imperative that you file in your returns on a yearly basis by preparing a Statement of Affairs whenever you are yet to effectively commence your business.

Why?

F.I.R.S as an institution needs to be communicated on the state of affairs of your business. Moreso, that is the only evidence F.I.R.S can lay hold on to that of a truth you are yet to start-off business operations. Words of mouth or stories will not help...

Step 3: We prepared the Statement of Affairs and sent it to the F.I.R.S for consideration on behalf of our client.

After much haggling, going back & forth, we finally reached an agreement on what to pay to the F.I.R.S which we did and in a month's time, our client collected his Tax Clearance Certificate and thereon submitted it to the bank.

Mind you, prior to the execution of the contract, he had shown the bank proofs that he was processing his TCC and also made photocopies of payments to the F.I.R.S he had made pending the issuance of the certificate which initially the banks didn’t accept but after so much pleading, he was giving the benefit of the doubt and so, when the original TCC finally came out, he gave a copy to the bank for record purpose.

Was he able to execute the contract? YES! He did Processing of Tax Clearance Certificate is a practical thing. Having a deep understanding of the dynamics and a whole lot of local wisdom helps out.

CASE STUDY #3

Another scenario where a Statement of Affairs will be prepared and submitted to the F.I.R.S for the processing of TCC is when the business has not spent more than 18months in commencement.

For example - assuming you commenced your business in January 2014. You have between January 1, 2014 to June 30, 2015 to submit your company’s Statement of Affairs. Submitting it July 1, 2015 means it is late by one month.

If you fail to file in for tax within this time frame, you’ll be liable to pay a penalty of N25,000 for the first month of default and N5,000 for subsequent months in the event the default continues.The Federal Government needs money to fund her budget and so they are doing everything in their power to generate as much funds as they can and Tax is one of the major revenue drivers.

I hope this helps.

Chidera

0802 318 9838, 07057179585

[email protected]

Accounting |Tax Solutions| Real Estate |ERP Consultant

Read also : Federal Government loan for businesses.

Author : Kekeocha Justin