CBN loan worth up to ₦2billion Naira

The Central Bank of Nigeria (CBN) is Nigeria's most prestigious bank. It is responsible for regulating the financial policies of the country. It is also responsible for regulating the monetary policies of Nigeria. The Central Bank of Nigeria has several funds for intervention targeted at small and large-scale enterprises.

The work of the CBN is comprised of the following:

- Giving people the opportunity to pay for goods and services safely, i.e., issuing banknotes and overseeing payments (e.g., MasterCard, Verve, and Visa)

- Stabilizing and lowering prices, i.e., controlling inflation

- Assuring that all Nigeria's banks run properly, i.e., regulation.

- Maintaining the entire Nigerian financial system in a stable state.

The CBN plays its role as the leading bank in the country by:

- We are analyzing and gathering data from microfinance banks, commercial banks, credit unions, and mortgage and insurance companies.

- Conducting research allows you to make better-informed decisions.

- Making sure that the people are always up-to current and know how the economy functions

One of the CBN's primary functions is to support small and medium-sized businesses (SMEs) by providing them with better access to funding or credit. It accomplishes this by implementing several initiatives in development finance.

The Central Bank of Nigeria works closely with many other government agencies, which include the Nigerian Export-Import Bank (NEXIM), the Development Bank of Nigeria (DBN), the Bank of Industry (BOI), and the Bank of Agriculture (BOA).

Intervention funds, as well as the types of loans offered by the Central Bank of Nigeria

Agri-Business Small and Medium Enterprises Investment Scheme (AGSMEIS)

AGSMEIS is a Federal Government of Nigeria intervention scheme administered through the CBN. The loan targets small, micro, and medium-sized companies (MSMEs) and aims to create more jobs and stimulate sustainable economic growth.

Read also : Federal Government loan for businesses.

Rates of interest are low (5 5 %)) and the loan tenors are lengthy (up to seven years). Business owners also have the option of an extended moratorium of 18 months for principal and six months for interest.

The eligible businesses are all MSMEs that are engaged in productive actions related to:

- Agricultural sector

- Sector of education

- Entire industry (manufacturing, mining, petrochemicals, etc.)

- Service sector (ICT, creative endeavor, etc.)

- Other businesses that are deemed appropriate by the CBN

Anchor the Borrower's Programme (ABP)

Essentially, the Anchor Borrower Programme gives farmers loans not secured by collateral. Additionally, they receive diverse inputs from the farm, e.g., fertilizer and seeds. The loan is repaid in cash or the equivalent amount in produce that has been harvested.

A maximum of N2 billion could be borrowed, with an interest rate of 9. The loan's maximum tenor is generally 24 months.

Businesses that use the agricultural product as their raw material (for manufacturing) are suitable to receive this loan. That is companies that are involved in agriculture.

Read also : CBN policy on bank charges.

The CBN aims to increase its production capacity of cassava maize, cotton, poultry rice, sorghum tomatoes, and much more through this program.

Commercial Agriculture Credit Scheme (CACS)

Agro-businesses could benefit from the central bank of Nigeria's N200 billion Commercial Agriculture Credit Scheme.

The CBN and the Federal Ministry of Agriculture created this facility. It is designed to speedily develop Nigeria's agriculture sector, create employment, and increase food security by granting loans to eligible businesses in the agro-allied industry.

The scheme has an interest rate of 9.9%. It is possible to borrow up to N2 billion Naira is available for borrowing, with loan tenors that can be as long as 60 months.

You may be eligible to apply for the CACS Fund if your company engages in operations like the cultivation of crops, fisheries, and raising animals.

Read also : Development bank of Nigeria (DBN) loan worth at least ₦10million.

Creative Industry Financing Initiative

The Creative Industry Financing Initiative enables firms to access 500 million dollars. This facility is open to entrepreneurs and SMEs that are involved in the following:

- Fashion

- Information Communication Technology

- Film distribution and production

- Production and distribution of music

- Students studying software engineering

The maximum interest rate can be charged at 9%, and the maximum repayment period is ten years.

Through this program, the CBN seeks to boost the creative industries, in which companies have struggled for a long time to meet the stringent collateral requirements -- that are part of conventional commercial loans.

Credit Support Scheme for The Healthcare Sector

The Central Bank of Nigeria has adopted measures to extend loans up to N100 billion to help intervention efforts focusing on the healthcare sector.

Through this program, the hope is that local pharmaceutical companies and related healthcare enterprises across the value chain can increase their capabilities to supply products and services to Nigerians.

Read also : Bank of Agriculture (BOA) Loan worth at least ₦5million.

Participants who are eligible for this scheme include:

- Manufacturers of healthcare products (pharmaceutical products as well as medical equipment)

- Healthcare services and medical facilities (clinics, diagnostic centers, fitness centers, hospitals, rehabilitation centers, etc.)

- Pharmaceutical and medical supplies (distribution as well as logistics)

- Other human health service providers, according to the criteria set by the CBN.

To finance working capital, the loan limit for working capital is 500 million Naira, which has a max loan tenure of one year. If you are looking for a term loan, the loan limit amounts to two billion Naira -with the loan's maximum tenor, that is, ten years. In both cases, the interest rates are determined at 9.9% annually.

Maize Aggregation Schema (MAS)

The Maize Aggregation Scheme is a work-capital facility. It assists Agro-businesses in purchasing home-grown maize. Companies involved in the following activities can be qualified to apply for the MAS Fund:

- Confectionery

- Feed Millers

- Poultry Farmers

- Silo Operators

- Warehouse Operators

The maximum tenor for the financing of 12 months. You can take out loans of as much as N2 billion at annual interest rates of 9.

Micro, Small, Medium Enterprises Development Fund (MSMEDF)

The CBN N220 billion Micro, Small, Medium Enterprises Development Fund is a one-digit interest rate (9%)) credit facility. It is available from participating Financial Institutions (PFIs), i.e., banks.

Read also : Nigerian Export-Import Bank (NEXIM) loan worth at least ₦10million.

The loan must be paid back within three years, and you can access as many as 50 million Nigerians.

Sixty percent of the fund is exclusively for women. The remaining 10% is reserved for startups.

The following sectors of businesses are eligible for the scheme

- The value chain for agricultural products

- Artisans

- Education

- Healthcare

- Manufacturing

- Renewable energy

- Services

- Commerce and trade

- Other economic activities, as determined by the CBN

10% of the money is allocated to support development goals via grants and capacity development. The remainder is for commercial purposes. The general fund is designed to improve MSMEs' access to credit, productivity, and new jobs.

Non-Oil Export Stimulation Facility (NESF)

The Export Stimulation Facility was created to assist in diversifying the source of revenue for the Nigerian Economy by helping the growth of the non-oil trade sector. The fund aims to reverse the decrease in finance for exports.

Read also : Bank of Industry (BOI) loan.

The scheme allows financing of any item that could aid Nigerian firm's export. In addition, it is helping to support the value chain of exports (everything from manufacturing facilities to transportation to warehouses). The scheme allows businesses to import the equipment and equipment needed to make and make goods for export.

Export-oriented businesses that have verified export off-take contracts are qualified to participate in the scheme. There is a loan limit of 5 billion Nigerians. They have a maximum loan term that is ten years. A 9 % interest rate is applicable percent is applicable.

Paddy Aggregation Scheme (PAS)

The Paddy Aggregation Scheme (PAS) scheme is a short-term bridging or work capital loan facility. It was designed to aid rice millers with purchasing paddy to process throughout the year.

The amount of 2 billion Naira is available for borrowing, with interest at 9% per year. Repayments must be made in 12-month intervals.

Real Sector Support Facility (RSSF)

Real Sector Support Facility's objectives are to boost output, create employment, diversify the income base, boost the exchange rate and supply inputs to the industrial sector and provide an ongoing basis for the economic system.

Read also : Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) Loan.

The CBN has allocated N300 billion to fund the scheme. The RSSF can be used to aid businesses that are starting up and also the growth plans and expansion strategies of established companies.

Businesses that operate in the following industries have priority

- Agro business

- Manufacturing

- Mining

- Solid minerals

Simple transactions are not covered under this scheme.

Credit may come as a term loan or working capital financing. The loans are suitable for the expansion or acquisition of assets and operating capital to be used to purchase raw materials.

A loan's tenor is between 10 and 15 years. Working capital facilities are tenor-free for one year. The facility can be used for up to N10 billion and could be borrowed at a minimum of N500 million. A rate of interest of 9% per year is applicable for any loan facility that is offered.

Read also : How To Open A Bank Account Abroad.

Eligible for a Central Bank of Nigeria loan

Any business that engages in productive activity could qualify for a loan as part of one of the various intervention programs of the Central Bank of Nigeria (highlighted above).

The CBN generally does not fund individuals. Therefore, you'll require a registered company or business through the Corporate Affairs Commission (CAC).

In addition, since CBN does not lend directly, CBN doesn't lend direct, it has to be a client from one of these banks, i.e., PFIs.

Eligible PFIs include all microfinance banks, non-governmental organizations-microfinance Institutions (NGO-MFIs), financial cooperatives, finance companies, development finance institutions (Bank of Agriculture and Bank of Industry), and deposit money banks (commercial banks).

How do you be eligible for a Central Bank of Nigeria loan?

Anyone applying for a CBN loan is advised to go to an eligible PFI (bank). When you are there, mention your desire to apply for a CBN loan.

Read also : Tips on saving and investing in the UK.

If you know which program (mentioned above) you'd prefer to apply to, you can specify this when submitting your application. If you need to confirm, the bank will likely provide you with choices by your business's present circumstances.

The bank will determine your company's potential and the need for the loan. If the assessment is favorable, the bank will submit to the CBN to fund your business.

The CBN will conduct its internal assessment before giving funds to your bank. Your bank will then be accountable for paying the loan on behalf of CBN.

The requirements for a CBN loan differ based on how big your company is, the amount of money you want to borrow, and the institution you are applying to.

In all honesty, some essential documents will nearly always be required, like an outline of the business plan, a statement of the purpose of the loan financial statements, and proof of collateral provided (if there is any).

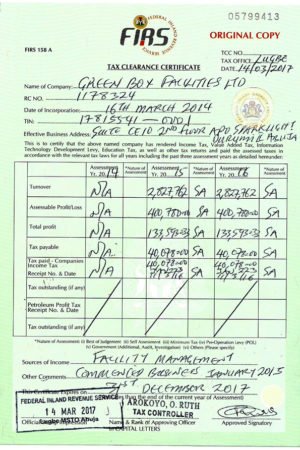

Read also : How Business Owners In Nigeria Can Obtain Tax Clearance Certificate With The F.I.R.S.

A list of the things you'll need is:

- Application form completed

- Company profile

- Business plan

- Budget for cash flow

- Statements from banks (12 months)

- Audited financial statements

- Certificate of Incorporation

- A valid means of identification (driving license (passport, driver's license, voters card)

- Address proof

- Information on collateral that is provided

Commonly inquired about questions (FAQs)

Do I have the option of borrowing straight from the Central Bank of Nigeria?

It is not possible to borrow directly through the CBN. They are paid out through Participating Financial Institutions (PFIs). They are required by law to evaluate your company's creditworthiness and oversee the approval of any loans.

What is the time frame to receive the money via the Central Bank of Nigeria?

The duration of an application process depends on the scheme being sought and the amount of money required. Specific schemes' process is entirely automated, allowing loans to be disbursed within six weeks after the application. Specific projects, vast sums of money, could require a longer time to complete.

What time frame must I follow to repay the Central Bank of Nigeria loan?

The loan terms are different based on the specific scheme used. It also depends on what you do with your company and the reason for the loan. The loan terms generally can vary from one up to 10 years. A moratorium or incubation period is also available.

What is the rate of interest for the Central Bank of Nigeria loan?

The interest rates charged for loans issued by the CBN are usually 9 percent. At its discretion, it may decide the CBN may decide to charge the interest rate at a lower rate. Specific schemes, including AGSMEIS, have an interest rate lower than usual.

What is the main difference between a Central Bank of Nigeria loan and a commercial loan?

With its intervention funds, CBN loans are directed at specific sectors that might have difficulty obtaining financing. Additionally, many of CBN's offerings are beneficial to SMEs through the possibility of longer repayment terms as well as lower rates of interest, i.e., soft loans.

What is the maximum amount I can take out of the Central Bank of Nigeria?

The amount you can take out through the CBN is dependent on the scheme you are applying for as well as the scale of your company. Small loans as low as a couple of million Naira can be granted in addition to larger loans that exceed one billion Naira.

Does Nigeria's Central Bank of Nigeria give grants?

The majority of the funds issued by CBN are in loans. From time to time, it is possible that the Central Bank of Nigeria offers grants to eligible businesses. If you are interested in an award, it's advised to speak directly to the CBN.

Do you have a deadline for the application for the Central Bank of Nigeria loan?

There is usually no time limit for applying for a CBN loan. However, the funds for intervention are accompanied by initial seed capital that may or may not is replenished after the depletion.

Is it true that The Central Bank of Nigeria requires collateral?

Because the CBN loans through intermediary banks, all of these banks typically have their own specific collateral requirements. But, in most cases, collateral is (but often not) needed. This is true of whatever bank or institution you make an application through. Acceptable collateral types include:

Read also : How to get settled after arriving in Canada.

- Obligations under obligations of the Federal Government of Nigeria (FGN Bonds, FGN Eurobonds, FGN Treasury Bills, etc.)

- Obligations of state governments and organizations that are part of the Federal Government of Nigeria

- Other non-government debt instruments

- Physical properties, e.g., real property

- Third-party Guarantors (or collateral)