Federal Government loan for businesses

Federal Business loans from the government could be an alternative for Nigerian entrepreneurs seeking to establish or grow a business.

The Nigerian government has a variety of initiatives that aid big and small-sized companies with funding -- however, the focus is on smaller companies.

The government is focused on small, medium, and large businesses (SMEs) for various reasons. One of the most important reasons is they believe that an SME sector is an essential element in a strong market economy. SME businesses comprise the vast majority of companies in Nigeria. In turn, they contribute enormous contributions to value-added and job creation.

The FGN assists businesses in funding through a range of government-backed agencies or organizations such as:

- Bank of Agriculture (BOA)

- Bank of Industry (BOI)

- Central Bank of Nigeria (CBN)

- Development Bank of Nigeria (DBN)

- Nigerian Export-Import Bank (NEXIM)

- Small and Medium Enterprises Development Agency of Nigeria (SMEDAN)

Based on the loan and agency products available, FGN loans come with various rates of interest and repayment plans.

Types of loans and funding are available through Nigeria's Federal Government of Nigeria.

Bank of Agriculture (BOA)

The Bank of Agriculture is a state-owned bank. It provides credit -- as well as other types of financing -for farmers and other agricultural businesses.

Read also : Bank of Agriculture (BOA) Loan worth at least ₦5million.

The BOA items and offerings include

- Agro-Processing Facility

- Direct Credit Product

- Equipment Leasing Product (ELP)

- Export Finance Facility

- Expand as well as Earn More (GEM)

- Haulage Credit Facility

- Loan Facility with Hides and Revival of Skin

- Credit Facility for Input Procurement

- Inventory Credit Facility

- Large Credit Product

- Ranching Development Credit Facility

- Sugar Revival Credit Facility

- Youth Agricultural Revolution in Nigeria (YARN)

Click here to apply to Bank Of Agriculture (BOA) Loan worth at least ₦5million

Bank of Industry (BOI)

The Bank Of Industry (BOI) Loan is a bank that provides long-term financing to the industry segment of the Nigerian economy. The main sectors of focus are agriculture processing, agro-processing, information communications technology, gas and oil, minerals, and the creative industry.

The BOI offerings and products include

- ASM Fund

- The bottom of the pyramid Pyramid

- Fashion and Beauty Products

- Light Manufacturing

- Processing of food and agro commodities

- Graduate Entrepreneurship Fund

- Nollyfund

- Loans to Commercial Banks

- Solar Energy

- Youth Entrepreneurship Support (Yes) Program

- Youth Ignite Program

- BOI/CBN Intervention Fund

- Cassava Bread Fund

- Cement Fund

- Cottage Fund

- FGN Special Intervention Fund for MSME (NEDEP)

- NADDC Fund

- National Program on Food Security (NPFS)

- Rice and Cassava Intervention Fund

- Sugar Development Council Fund

- BOI/State Matching Funds

- BOI/Dangote Foundation Matching Funds

Click here to apply Bank Of Industry (BOI) Loan

Read also : CBN loan worth up to ₦2billion Naira.

Central Bank of Nigeria (CBN)

Through various development finance activities, the Central Bank of Nigeria offers a range of loans for businesses throughout the nation.

A few examples of CBN Services and products include

- Anchor the Borrower's Programme (ABP)

- Commercial Agriculture Credit Scheme (CACS)

- Creative Industry Financing Initiative

- Credit Support Scheme for The Healthcare Sector

- Maize Aggregation Schema (MAS)

- Micro, Small, Medium Enterprises Development Fund (MSMEDF)

- Non-Oil Export Stimulation Facility (NESF)

- Paddy Aggregation Scheme (PAS)

- Real Sector Support Facility (RSSF)

Click here to apply to CBN Loan Worth Up To ₦2billion Naira

Development Bank of Nigeria (DBN)

The Development Bank of Nigeria is a bank that is a wholesale financial institution. The DBN aims to improve credit available to micro, small, and medium-sized businesses (MSMEs).

A few examples of DBN Services and goods include

Read also : Development bank of Nigeria (DBN) loan worth at least ₦10million.

- Wholesale credit

- Partial credit risk guarantees

- Capacity building - The capacity building program of the DBN Entrepreneurship Training Program

Click here to apply to Development bank of Nigeria (DBN) loan worth at least ₦10million

Nigerian Export-Import Bank (NEXIM)

The Nigerian Export-Import Bank is a bank that was established for the export of services and goods in Nigeria. Businesses that are involved in export-related activities are eligible for a NEXIM loan.

The NEXIM solutions and products include

- Direct Lending Facility

- Foreign Input Facility

- Local Input Facility

- Nigerian Creative Industries and Entertainment Loans

- Small and Medium Enterprise Export Facility (SMEEF)

- Storage Facility (SF)

- Women and Youth Export Facility (WAYEF)

- Export Development Facility (EDF)

- Trade and Investment Promotion for Nigerians from Africa Program (NATIPP)

- Rediscounting as well as refinancing facility (RRF)

- Foreign Credit Guarantee Facility

- Export Credit Insurance Facility

Click here to apply to Nigerian Export-Import Bank (NEXIM) Loan Worth At Least ₦10million

Small and Medium Enterprises Development Agency of Nigeria (SMEDAN)

SMEDAN is charged with encouraging, monitoring, and coordinating the growth of MSMEs across Nigeria. In addition to its responsibilities, SMEDAN also helps MSMEs access credit and other types of financing.

Read also : Nigerian Export-Import Bank (NEXIM) loan worth at least ₦10million.

A few examples of SMEDAN Services and goods include

- Automotive (Component Parts Fabrication) Empowerment Plan

- Commercialization Empowerment Initiative (for ICT)

- Conditional Grant Scheme (CGS)

- Enterprise Network Initiatives

- Financial Empowerment for MSMEs

- Garment and Textile Cluster Growth Support Scheme

- Hewlett Packard - Learning Initiative for Entrepreneurs (HP - Life)

- Leather Cluster Enterprises Scheme

- MSME Market Linkage Initiative

- One-Local Government-One-Product (OLOP)

- SMEDAN Cloud for MSMEs

- The Waste-to-Wealth Cluster Enhancement and Development Enhancement Scheme

- Young Business Owners in Nigeria (Y-BON)

Click here to apply to Small And Medium Enterprises Development Agency Of Nigeria (SMEDAN) Loan

Eligible for the Federal Government of Nigeria loan

Anyone who lives in Nigeria can apply to receive a Federal Government of Nigeria loan -- provided they have an existing business or wish to establish one.

Based on the loan you're seeking, the company is not required to register with Corporate Affairs Commission (CAC) to be eligible. If your company needs to be registered, it typically has to be registered as a part of the financing program or initiative you are interested in.

Furthermore, based on the kind of business you operate, you may need to register at the National Agency for Food and Drug Administration and Control (NAFDAC) as well as also known as the Nigerian Export Promotion Council (NEPC), and the Standards Organization of Nigeria (SON).

Read also : Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) Loan.

Both limited liability companies and registered business names are eligible for an FGN loan. The amount you can apply for as a limited company is much higher.

To qualify for government loans, your company must have a history of trading, i.e., it must have been operational. Others FGN loans do not meet these criteria, so new businesses should consider applying.

These loans, which The Federal Government provides, are managed and distributed by various agencies within the federal government. Each agency will have its particular requirements or lending guidelines.

Therefore, your business might only be suitable for some funding schemes and programs operated under the FGN. For instance, if your company does not export products or services, it is not eligible for an NXIM loan. Also, if your company does not involve in agriculture, then a BOA loan is not on the table. So on and so on.

Based on the credit facility being used the government loan can be utilized for a range of purposes, including -the possibility of leasing machines, buying stock, or even as an initial loan.

Read also : Bank of Industry (BOI) loan.

The loans for purchasing real property typically are not guaranteed.

How do you apply for a Federal Government of Nigeria loan?

A government loan application involves researching and finding an appropriate product you both qualify to apply for, compatible with your specific business requirements.

Since most loans are managed by government agencies specific to a particular sector, you'll need to either directly apply to these organizations or through a commercial bank that is a participant.

Specific applications can be completed on the internet. Still, most applications will require you to go to the appropriate branch or office to fill out the application on-site.

The suitability of your business and the reason for the loan would be evaluated by the guidelines for the loan facility or funding program you are interested in. If you're approved for financing, the funds will be credited to you according to the conditions of any approval letter.

Read also : Tips on saving and investing in the UK.

No matter what agency, credit facility, or financing initiative you're applying to, certain documents of a fundamental nature are usually required. A list of the documents that may be needed is as follows:

- The completed application form

- Company profile

- Business plan

- Budget for cash flow

- Statements from banks (12 months)

- Audited financial statements

- Certificate of Incorporation

- A valid means of identification (driving license or passport, voter's card, etc.)

- Address proof

- The details of the collateral that is offered

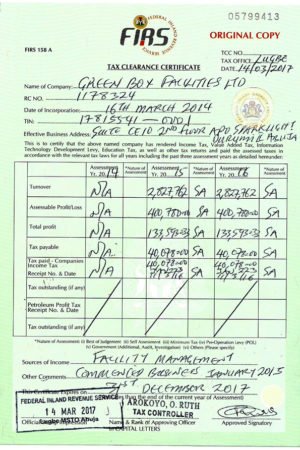

The checklist needs to provide a complete or required document list. For instance, if you're a new business and you are not required to have the financial statements of an auditor or an Incorporation Certificate. However, when you're a sizeable limited business and require items like a tax clearance certificate and many other things.

Most frequently inquired about questions (FAQs)

What is the time frame to receive funds through Nigeria's Federal Government of Nigeria?

The financing program or the credit facility requested is the primary aspect that determines the length of the application process. It generally takes longer to approve a government loan than to seek money through the private market. However, this is only sometimes the scenario.

What amount can I get from the Federal Government of Nigeria?

The amount you can borrow is different. In general, the larger and more established your business, the greater you can take out. Government schemes may provide loans that start as low as just a handful of Nigerians and as high as and even exceeding a billion Nigerians.

Do The Federal Government of Nigeria give grants?

Yes, schemes and programs culminate in the FGN providing grants instead of loans. An appropriate government agency will manage each grant scheme.

Read also : How Business Owners In Nigeria Can Obtain Tax Clearance Certificate With The F.I.R.S.

Does Nigeria's Federal Government of Nigeria require collateral?

Depending on the financing program you are applying for, the primary determinant is whether collateral might or may not be needed. However, collateral will most likely be required when huge sums are being lent. If you don't have collateral personal or third-party guarantees could be acceptable.